Am I Required to File Taxes?

The Internal Revenue Service (IRS) is the government entity that requires us to pay income taxes. They require most U.S. citizens or permanent residents who work in the U.S. to pay income taxes.

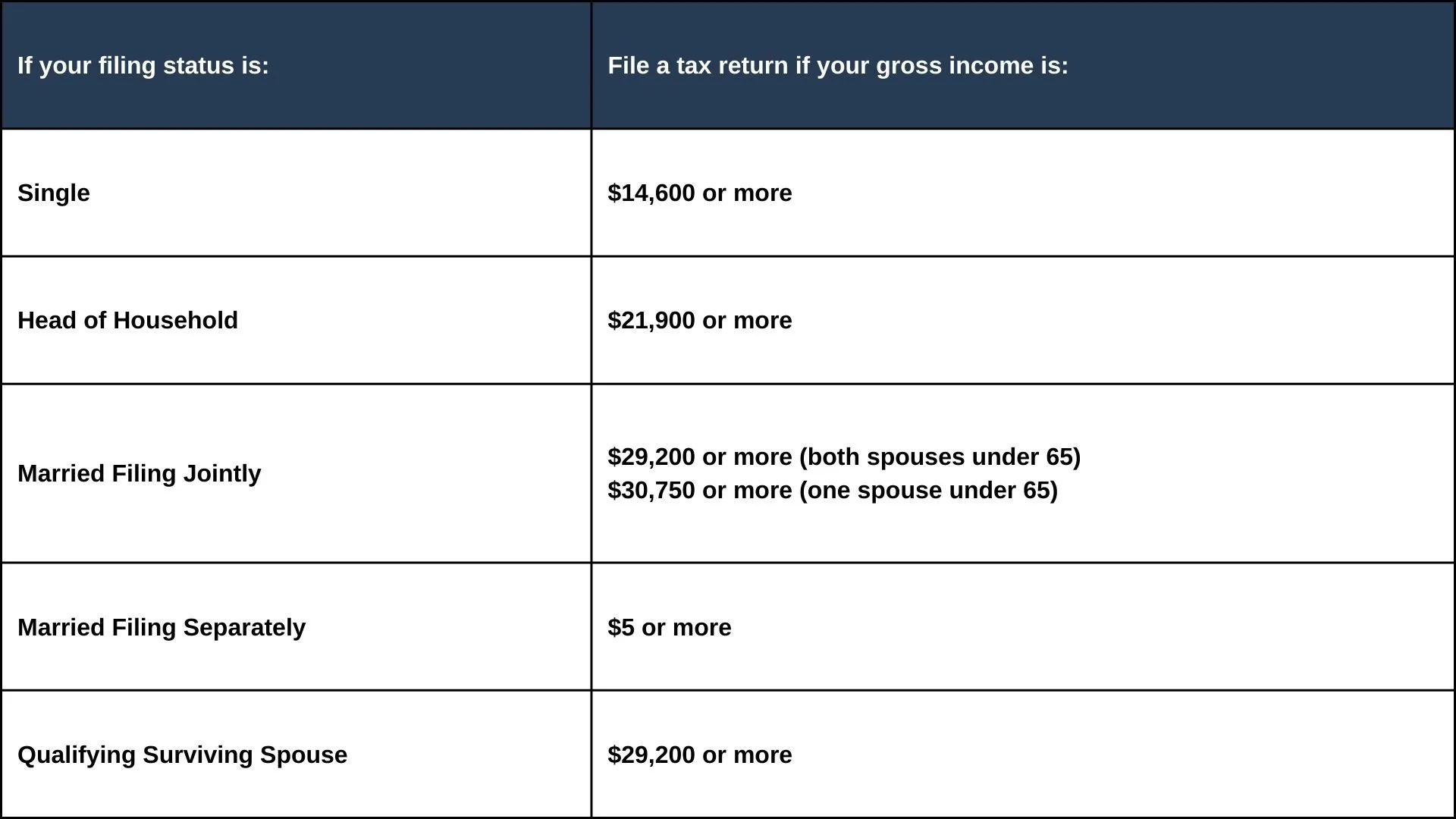

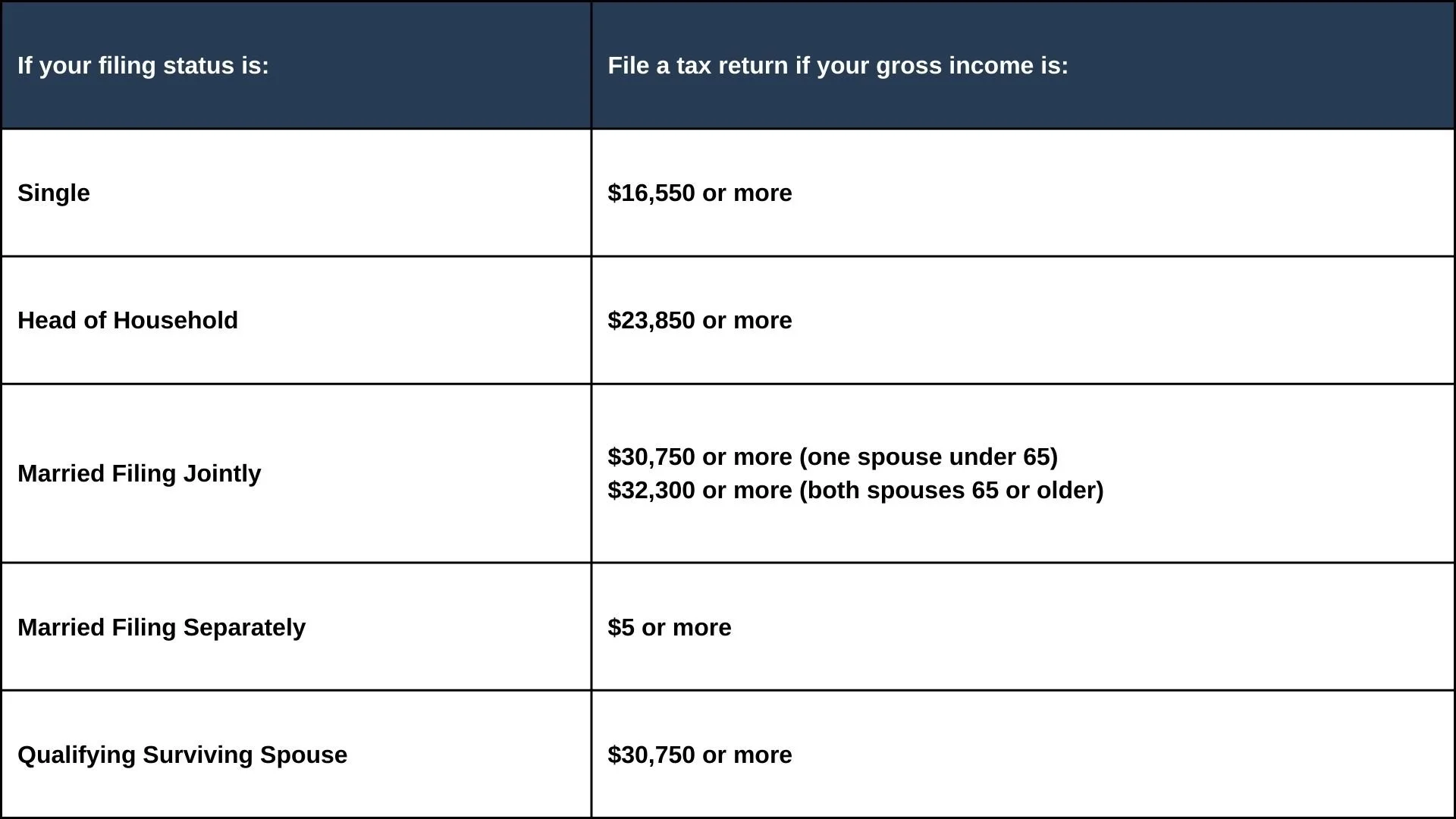

If you received $400 or more from self-employment or if you meet the filing requirement below you need to file income taxes.

IF YOU WERE UNDER 65 AT THE END OF 2024:

IF YOU WERE 65 OR OLDER AT THE END OF 2024:

Parents can report their children’s income on their own tax return and pay the taxes for them if the children are under 19 years old (or under 24 if a student) and their only income came from interest and dividends that totaled less than $13,000.

You may want to file income taxes even if you aren’t required to if your paycheck had federal income tax withheld or you made estimated tax payments at any point throughout the year. The biggest reason for filing anyway in these cases is because you may have overpaid. In that case, the government owes you a refund.

Now, if you are receiving a refund, its because you paid too much during the year. If this happens, you will want to see your Human Resources Department to adjust your withholding. By lowering the amount your employer withholds each paycheck, you’ll increase the amount of money you receive in your paycheck right away in exchange for a smaller refund next year. A lot of people are hesitant to do this because they like receiving that big refund after they file. If you like the idea of a big check once a year, adjust your withholding anyway. Then, when you start getting those increased pay checks, save or invest the extra money in your own account. There, your money will earn interest or dividends, and you can cash out even more than what the government would have reimbursed you (remember, the government doesn’t give you interest on your overpayments. You just lent them your money over the course of a year, and then they gave it back with no benefit to you.) The beautiful thing about saving your extra money and giving yourself your own refund is that you can access the money whenever you’d like, not just at tax time, and it’s growing every month you keep it saved/invested. Poor people who want to stay poor rely on tax refunds. Those who want to grow their wealth don’t hand over extra to the government in the first place, but invest it instead.

If you want to learn more smart money moves and how to think like a wealth-builder, schedule an appointment with a financial coach today to get started.